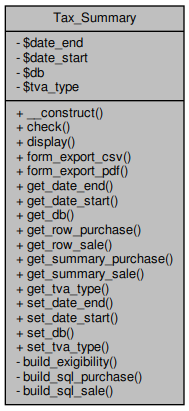

Compute , display and export the tax summary. More...

Collaboration diagram for Tax_Summary:

Collaboration diagram for Tax_Summary:Public Member Functions | |

| __construct (Database $db, $p_start, $p_end) | |

| build_link_detail ($dossier_id, $dateStart, $DateeEd, $nLedger_id, $nVAT_id) | |

| Build a link to show the detail of a VAT ID. | |

| check () | |

| depends of quant_* table, so we must check first that everything is in these tables | |

| display () | |

| display the summary of VAT in the range of date | |

| form_export_csv () | |

| display a form to export in CSV | |

| form_export_pdf () | |

| display a form to export in PDF | |

| get_date_end () | |

| get_date_start () | |

| get_db () | |

| get_row_purchase () | |

| Total for each purchase ledger. | |

| get_row_sale () | |

| Total for each sales ledger. | |

| get_summary_purchase () | |

| Summary for all purchase ledgers. | |

| get_summary_sale () | |

| Summary for all sales ledger. | |

| get_tva_type () | |

| set_date_end ($date_end) | |

| set_date_start ($date_start) | |

| set_db ($db) | |

| set_tva_type ($tva_type) | |

Private Member Functions | |

| build_exigibility () | |

| build_sql_purchase ($p_group_ledger) | |

| Build the SQL for sale vat. | |

| build_sql_sale ($p_group_ledger=TRUE) | |

| Build the SQL for sale vat. | |

Private Attributes | |

| $date_end | |

| $date_start | |

| $db | |

| $tva_type | |

| exigibility of VAT : operation , payment date or depending of setting in tva_rate | |

Detailed Description

Compute , display and export the tax summary.

Definition at line 35 of file tax_summary.class.php.

Constructor & Destructor Documentation

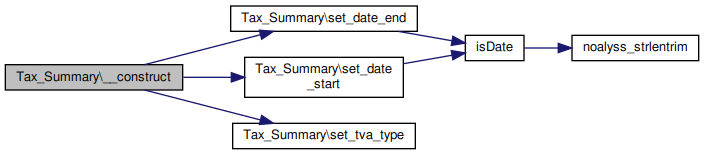

◆ __construct()

| Tax_Summary::__construct | ( | Database | $db, |

| $p_start, | |||

| $p_end ) |

Definition at line 43 of file tax_summary.class.php.

References $db, $p_end, $p_start, db, set_date_end(), set_date_start(), and set_tva_type().

Here is the call graph for this function:

Here is the call graph for this function:Member Function Documentation

◆ build_exigibility()

|

private |

Definition at line 180 of file tax_summary.class.php.

References $g_user.

◆ build_link_detail()

| Tax_Summary::build_link_detail | ( | $dossier_id, | |

| $dateStart, | |||

| $DateeEd, | |||

| $nLedger_id, | |||

| $nVAT_id ) |

Build a link to show the detail of a VAT ID.

- Parameters

-

$dateStart date from format 'DD.MM.YYYY' $DateeEd date to format 'DD.MM.YYYY' $nLedger_id integer JRN_DEF.JRN_DEF_ID $nVAT_id integer TVA_RATE.TVA_ID

- Returns

- javascript string

Definition at line 494 of file tax_summary.class.php.

References $dossier_id, and $js.

◆ build_sql_purchase()

|

private |

Build the SQL for sale vat.

- Returns

- string

Definition at line 191 of file tax_summary.class.php.

References $g_user, $sql, _, and elseif.

Referenced by get_row_purchase(), and get_summary_purchase().

◆ build_sql_sale()

|

private |

Build the SQL for sale vat.

- Parameters

-

$p_group_ledger bool true group by ledgers

- Returns

- string

Definition at line 267 of file tax_summary.class.php.

References $g_user, $sql, _, and elseif.

Referenced by get_row_sale(), and get_summary_sale().

◆ check()

| Tax_Summary::check | ( | ) |

depends of quant_* table, so we must check first that everything is in these tables

Definition at line 124 of file tax_summary.class.php.

◆ display()

| Tax_Summary::display | ( | ) |

display the summary of VAT in the range of date

Definition at line 444 of file tax_summary.class.php.

◆ form_export_csv()

| Tax_Summary::form_export_csv | ( | ) |

display a form to export in CSV

- See also

- export_printtva_csv.php

Definition at line 453 of file tax_summary.class.php.

◆ form_export_pdf()

| Tax_Summary::form_export_pdf | ( | ) |

display a form to export in PDF

- See also

- export_printtva_pdf.php

Definition at line 472 of file tax_summary.class.php.

◆ get_date_end()

| Tax_Summary::get_date_end | ( | ) |

- Returns

- mixed

Definition at line 103 of file tax_summary.class.php.

References $date_end.

◆ get_date_start()

| Tax_Summary::get_date_start | ( | ) |

◆ get_db()

| Tax_Summary::get_db | ( | ) |

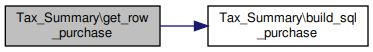

◆ get_row_purchase()

| Tax_Summary::get_row_purchase | ( | ) |

Total for each purchase ledger.

- Returns

- array

Definition at line 365 of file tax_summary.class.php.

References $array, $sql, build_sql_purchase(), and db.

Here is the call graph for this function:

Here is the call graph for this function:◆ get_row_sale()

| Tax_Summary::get_row_sale | ( | ) |

Total for each sales ledger.

- Returns

- array

Definition at line 337 of file tax_summary.class.php.

References $array, $sql, build_sql_sale(), and db.

Here is the call graph for this function:

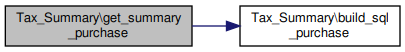

Here is the call graph for this function:◆ get_summary_purchase()

| Tax_Summary::get_summary_purchase | ( | ) |

Summary for all purchase ledgers.

Definition at line 416 of file tax_summary.class.php.

References $array, $sql, build_sql_purchase(), and db.

Here is the call graph for this function:

Here is the call graph for this function:◆ get_summary_sale()

| Tax_Summary::get_summary_sale | ( | ) |

Summary for all sales ledger.

Definition at line 393 of file tax_summary.class.php.

References $array, $sql, build_sql_sale(), and db.

Here is the call graph for this function:

Here is the call graph for this function:◆ get_tva_type()

| Tax_Summary::get_tva_type | ( | ) |

Definition at line 53 of file tax_summary.class.php.

References $tva_type.

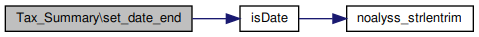

◆ set_date_end()

| Tax_Summary::set_date_end | ( | $date_end | ) |

- Parameters

-

mixed $date_end

Definition at line 112 of file tax_summary.class.php.

References $date_end, _, and isDate().

Referenced by __construct().

Here is the call graph for this function:

Here is the call graph for this function:◆ set_date_start()

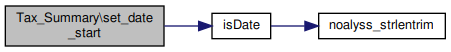

| Tax_Summary::set_date_start | ( | $date_start | ) |

- Parameters

-

mixed $date_start

Definition at line 92 of file tax_summary.class.php.

References $date_start, _, and isDate().

Referenced by __construct().

Here is the call graph for this function:

Here is the call graph for this function:◆ set_db()

| Tax_Summary::set_db | ( | $db | ) |

◆ set_tva_type()

| Tax_Summary::set_tva_type | ( | $tva_type | ) |

Definition at line 58 of file tax_summary.class.php.

References $tva_type.

Referenced by __construct().

Field Documentation

◆ $date_end

|

private |

Definition at line 39 of file tax_summary.class.php.

Referenced by get_date_end(), and set_date_end().

◆ $date_start

|

private |

Definition at line 38 of file tax_summary.class.php.

Referenced by get_date_start(), and set_date_start().

◆ $db

|

private |

Definition at line 40 of file tax_summary.class.php.

Referenced by __construct(), get_db(), and set_db().

◆ $tva_type

|

private |

exigibility of VAT : operation , payment date or depending of setting in tva_rate

Definition at line 41 of file tax_summary.class.php.

Referenced by get_tva_type(), and set_tva_type().

The documentation for this class was generated from the following file:

- include/class/tax_summary.class.php

Generated on Thu Jan 15 2026 10:14:41 for noalyss by