|

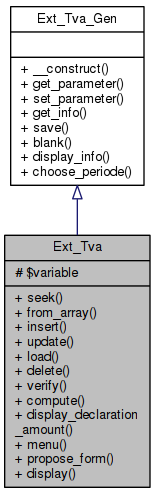

Plugins

LAST

|

Public Member Functions | |

| seek ($cond, $p_array=null) | |

| retrieve * row thanks a condition More... | |

| from_array ($p_array) | |

| insert () | |

| update () | |

| load () | |

| delete () | |

| verify () | |

| compute () | |

| compute the amount More... | |

| display_declaration_amount () | |

| get into the table quant_purchase or quant_sold the amount of VAT More... | |

| menu () | |

| propose_form () | |

| display () | |

| get_parameter ($p_string) | |

| set_parameter ($p_string, $p_value) | |

| get_info () | |

| save () | |

| blank ($p_year, $p_periode, $p_flag_quaterly) | |

| display_info () | |

| display the information about the company More... | |

Static Public Member Functions | |

| static | choose_periode ($by_year=false) |

Protected Attributes | |

| $variable | |

Definition at line 30 of file class_ext_tva.php.

|

inherited |

Definition at line 132 of file class_ext_tvagen.php.

References $GLOBALS, $p_year, and Ext_Tva_Gen\set_parameter().

|

staticinherited |

Definition at line 82 of file class_ext_tvagen.php.

References $_REQUEST, $array, $by_year, $r, $str_byyear, $str_hidden, $str_month, $str_monthly, $str_quater, $str_quaterly, $str_submit, $str_year, and $year.

| Ext_Tva::compute | ( | ) |

compute the amount

Definition at line 197 of file class_ext_tva.php.

References $amount, $array, and Ext_Tva_Gen\set_parameter().

| Ext_Tva::delete | ( | ) |

Definition at line 178 of file class_ext_tva.php.

| Ext_Tva::display | ( | ) |

Definition at line 533 of file class_ext_tva.php.

References $r, display_declaration_amount(), Ext_Tva_Gen\display_info(), and menu().

| Ext_Tva::display_declaration_amount | ( | ) |

get into the table quant_purchase or quant_sold the amount of VAT

| @param |

Definition at line 283 of file class_ext_tva.php.

References $r, and Ext_Tva_Gen\get_parameter().

Referenced by display().

|

inherited |

display the information about the company

Definition at line 182 of file class_ext_tvagen.php.

References $exercice, $r, and $str_date.

Referenced by Ext_List_Intra\display(), Ext_List_Assujetti\display(), and display().

| Ext_Tva::from_array | ( | $p_array | ) |

Definition at line 86 of file class_ext_tva.php.

|

inherited |

Definition at line 72 of file class_ext_tvagen.php.

|

inherited |

Definition at line 54 of file class_ext_tvagen.php.

Referenced by Ext_List_Intra\display_declaration_amount(), Ext_List_Assujetti\display_declaration_amount(), display_declaration_amount(), and Ext_Tva_Gen\save().

| Ext_Tva::insert | ( | ) |

Definition at line 103 of file class_ext_tva.php.

| Ext_Tva::load | ( | ) |

Definition at line 167 of file class_ext_tva.php.

| Ext_Tva::menu | ( | ) |

Definition at line 327 of file class_ext_tva.php.

References $_REQUEST, $array, $r, and id.

Referenced by display().

| Ext_Tva::propose_form | ( | ) |

Definition at line 348 of file class_ext_tva.php.

References $amount, $array, $atva, $lib, $max, $per, $periode, and $r.

|

inherited |

| Ext_Tva::seek | ( | $cond, | |

$p_array = null |

|||

| ) |

|

inherited |

Definition at line 62 of file class_ext_tvagen.php.

Referenced by Ext_Tva_Gen\blank(), and compute().

| Ext_Tva::update | ( | ) |

| Ext_Tva::verify | ( | ) |

Definition at line 184 of file class_ext_tva.php.

|

protected |

Definition at line 32 of file class_ext_tva.php.

1.8.6

1.8.6