|

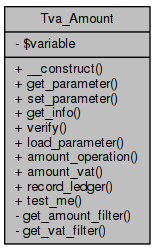

| | get_amount_filter ($p_code, $p_account) |

| | get the amount of operation from the table quant_sold or quant_purchase More...

|

| |

| | get_vat_filter ($p_code, $p_account) |

| | get the amount of VAT from the table quant_sold or quant_purchase More...

|

| |

Definition at line 32 of file class_tva_amount.php.

| Tva_Amount::__construct |

( |

|

$p_init, |

|

|

|

$p_dir, |

|

|

|

$p_start_periode, |

|

|

|

$p_end_periode |

|

) |

| |

Definition at line 43 of file class_tva_amount.php.

45 $this->start_periode=$p_start_periode;

46 $this->end_periode=$p_end_periode;

| Tva_Amount::amount_operation |

( |

| ) |

|

get the amount of vat thanks its code

- Parameters

-

| $p_gril | is the gril code |

| $p_dir | is out or in in for the table quant_purchase and out for the table quant_sold |

- Returns

- a number

Definition at line 89 of file class_tva_amount.php.

References get_amount_filter(), and load_parameter().

94 for ($i=0;$i<count($this->param);$i++)

96 $tmp_calc=$this->

get_amount_filter($this->param[$i][

'tva_id'],$this->param[$i][

'pcm_val']);

97 $result=bcadd($result,$tmp_calc);

100 return round($result,2);

get_amount_filter($p_code, $p_account)

get the amount of operation from the table quant_sold or quant_purchase

load_parameter()

load parameters and set param to a array of value from parameter_chld

| Tva_Amount::amount_vat |

( |

| ) |

|

Definition at line 104 of file class_tva_amount.php.

References get_vat_filter(), and load_parameter().

109 for ($i=0;$i<count($this->param);$i++)

111 $tmp_calc=$this->

get_vat_filter($this->param[$i][

'tva_id'],$this->param[$i][

'pcm_val']);

112 $result=bcadd($result,$tmp_calc);

115 return round($result,2);

get_vat_filter($p_code, $p_account)

get the amount of VAT from the table quant_sold or quant_purchase

load_parameter()

load parameters and set param to a array of value from parameter_chld

| Tva_Amount::get_amount_filter |

( |

|

$p_code, |

|

|

|

$p_account |

|

) |

| |

|

private |

get the amount of operation from the table quant_sold or quant_purchase

- Returns

- amount

Definition at line 124 of file class_tva_amount.php.

References $res, and $sql.

Referenced by amount_operation().

125 if ( $this->dir ==

'out' && trim($p_account) !=

'' && trim($p_code) !=

'' ) {

126 $sql=

"select coalesce(sum(qs_price),0) as amount from quant_sold

127 join jrnx using (j_id)

128 where qs_vat_code=$1 and (j_date >= to_date($2,'DD.MM.YYYY') and j_date <= to_date($3,'DD.MM.YYYY'))

129 and j_poste::text like ($4)";

130 $res=$this->db->get_array(

$sql,array($p_code,

131 $this->start_periode,

134 return $res[0][

'amount'];

137 if ( $this->dir ==

'in' && trim($p_account) !=

'' && trim($p_code) !=

'' ) {

138 $sql=

"select coalesce(sum(qp_price),0) as amount from quant_purchase join jrnx using (j_id)

139 where qp_vat_code=$1 and (j_date >= to_date($2,'DD.MM.YYYY') and j_date <= to_date($3,'DD.MM.YYYY'))

140 and j_poste::text like ($4)";

141 $res=$this->db->get_array(

$sql,array($p_code,

142 $this->start_periode,

145 return $res[0][

'amount'];

| Tva_Amount::get_parameter |

( |

|

$p_string | ) |

|

Definition at line 49 of file class_tva_amount.php.

50 if ( array_key_exists($p_string,self::$variable) ) {

51 $idx=self::$variable[$p_string];

55 throw new Exception(

"Attribut inexistant $p_string");

| Tva_Amount::get_vat_filter |

( |

|

$p_code, |

|

|

|

$p_account |

|

) |

| |

|

private |

get the amount of VAT from the table quant_sold or quant_purchase

- Returns

- amount

Definition at line 156 of file class_tva_amount.php.

References $res, and $sql.

Referenced by amount_vat().

157 if ( $this->dir ==

'out' && trim($p_account) !=

'' && trim($p_code) !=

'' ) {

158 $sql=

"select coalesce(sum(qs_vat),0) as amount from quant_sold join jrnx using (j_id)

159 where qs_vat_code=$1 and (j_date >= to_date($2,'DD.MM.YYYY') and j_date <= to_date($3,'DD.MM.YYYY'))

160 and j_poste::text like ($4)";

161 $res=$this->db->get_array(

$sql,array($p_code,

162 $this->start_periode,

165 return $res[0][

'amount'];

168 if ( $this->dir ==

'in' && trim($p_account) !=

'' && trim($p_code) !=

'' ) {

169 $sql=

"select coalesce(sum(qp_vat),0) as amount from quant_purchase join jrnx using (j_id)

170 where qp_vat_code=$1 and (j_date >= to_date($2,'DD.MM.YYYY') and j_date <= to_date($3,'DD.MM.YYYY'))

171 and j_poste::text like ($4)";

172 $res=$this->db->get_array(

$sql,array($p_code,

173 $this->start_periode,

176 return $res[0][

'amount'];

| Tva_Amount::load_parameter |

( |

| ) |

|

load parameters and set param to a array of value from parameter_chld

Definition at line 74 of file class_tva_amount.php.

Referenced by amount_operation(), and amount_vat().

76 $ctva=$this->db->get_array(

"select tva_id,pcm_val from tva_belge.parameter_chld where pcode=$1",array($this->grid));

77 if ( count($ctva)== 0 ) {

| Tva_Amount::record_ledger |

( |

| ) |

|

record into the ledger the operation for purging the the vat accouting

Definition at line 188 of file class_tva_amount.php.

| Tva_Amount::set_parameter |

( |

|

$p_string, |

|

|

|

$p_value |

|

) |

| |

Definition at line 57 of file class_tva_amount.php.

58 if ( array_key_exists($p_string,self::$variable) ) {

59 $idx=self::$variable[$p_string];

63 throw new Exception(

"Attribut inexistant $p_string");

| static Tva_Amount::test_me |

( |

| ) |

|

|

static |

Initial value:=array('amount'=>'amount',

'amount_tva'=>'amount_tva',

'param'=>'param',

'dir'=>'dir',

'start_periode'=>'start_periode',

'end_periode'=>'end_periode',

'grid'=>'grid'

)

Definition at line 35 of file class_tva_amount.php.

The documentation for this class was generated from the following file:

1.8.6

1.8.6